Appraised residential value appeals due March 28

You’ve received your appraised value by now. If you’ve reviewed your appraised value and don’t believe it is appraised at fair market value, you can appeal. You have until Wednesday, March 28 to file your appeal.

It is important to understand what is meant by the term “fair market value.” This refers to the amount of money that a well-informed buyer is willing to pay and a well-informed seller is willing to accept for property. The market conditions must be open and competitive, assuming that the parties are acting without undue compulsion.

There are 3 steps to the process:

1. File your appeal: The instructions and form are on the back of the notice of appraised value (see image).

2. Prepare for your appeal: Gather up documents that support that your property’s appraised value. Pictures of structural damage, decades-old appliances and carpet and repair estimates would be good. Even a signed sales contract for a lower value is another example of acceptable documentation to send to the county appraiser’s office.

3. Conduct the Appeal: When you schedule the informal hearing, you can request a meeting or even a phone hearing to best fit your schedule. These can be day or night.

Appraised Value Appeals

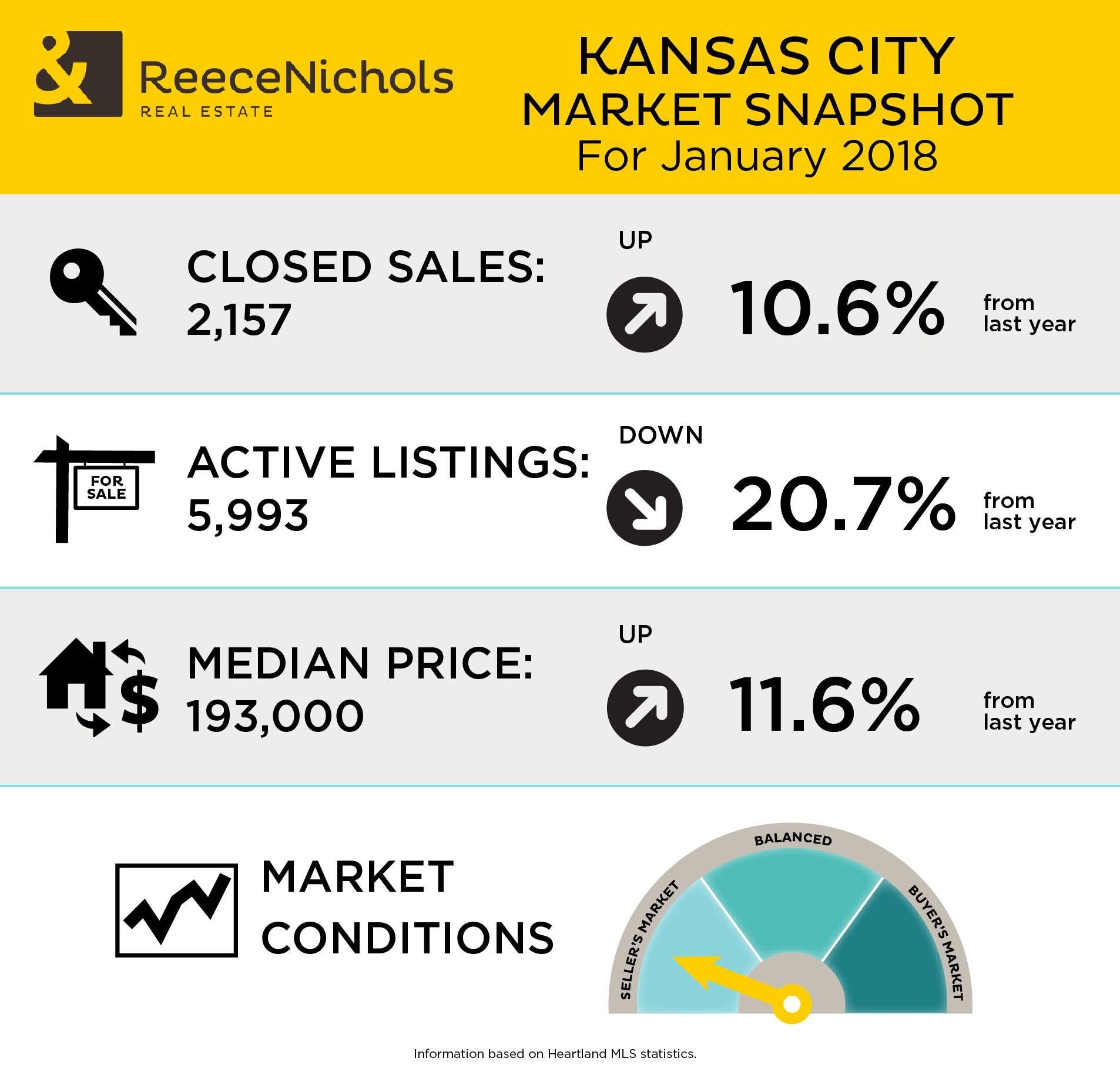

Amazingly, in 2017, 40-50% of the more than 5,000 residents who submitted appeals received an adjustment to their appraisal. The state requires the county appraiser to annually appraise homes based on fair market value. The county must use comparisons of homes sold around Jan. 1, 2018.

For more information on the appeal process, including specific examples of how to prepare for your appeal, visit the County Appraiser’s Website.

For more information on the appraisal process and how it relates to your property taxes, you can view this quick fact sheet.

Direct specific questions about the process or your property to the Johnson County Appraiser’s Office by calling (913) 715-9000.

If your appraisal has you wanting to sell, we can help! Cami Jones Collaborative offers unparalleled support when it comes to helping our sellers. We work with buyers and sellers alike, so no matter which side of the sale you’re on, we are by your side. Call us today! 913-402-2550.